Sector Overview

The industrial and manufacturing sector is the backbone of North America’s economy, spanning machining, fabrication, packaging, and specialized production. At VistaNova M&A Partners, we combine deep financial expertise with industry knowledge to guide owners through complex M&A transactions. Whether you’re preparing for succession, seeking an acquisition, or evaluating financing options, our tailored approach ensures clarity, confidentiality, and results.

Industries We Serve

From component production to finished goods assembly, we prepare manufacturing businesses for strategic exits or acquisitions in a sector where operational efficiency and scalability are critical. Our M&A advisory team understands the unique valuation drivers that strategic buyers and private equity firms prioritize in manufacturing transactions.

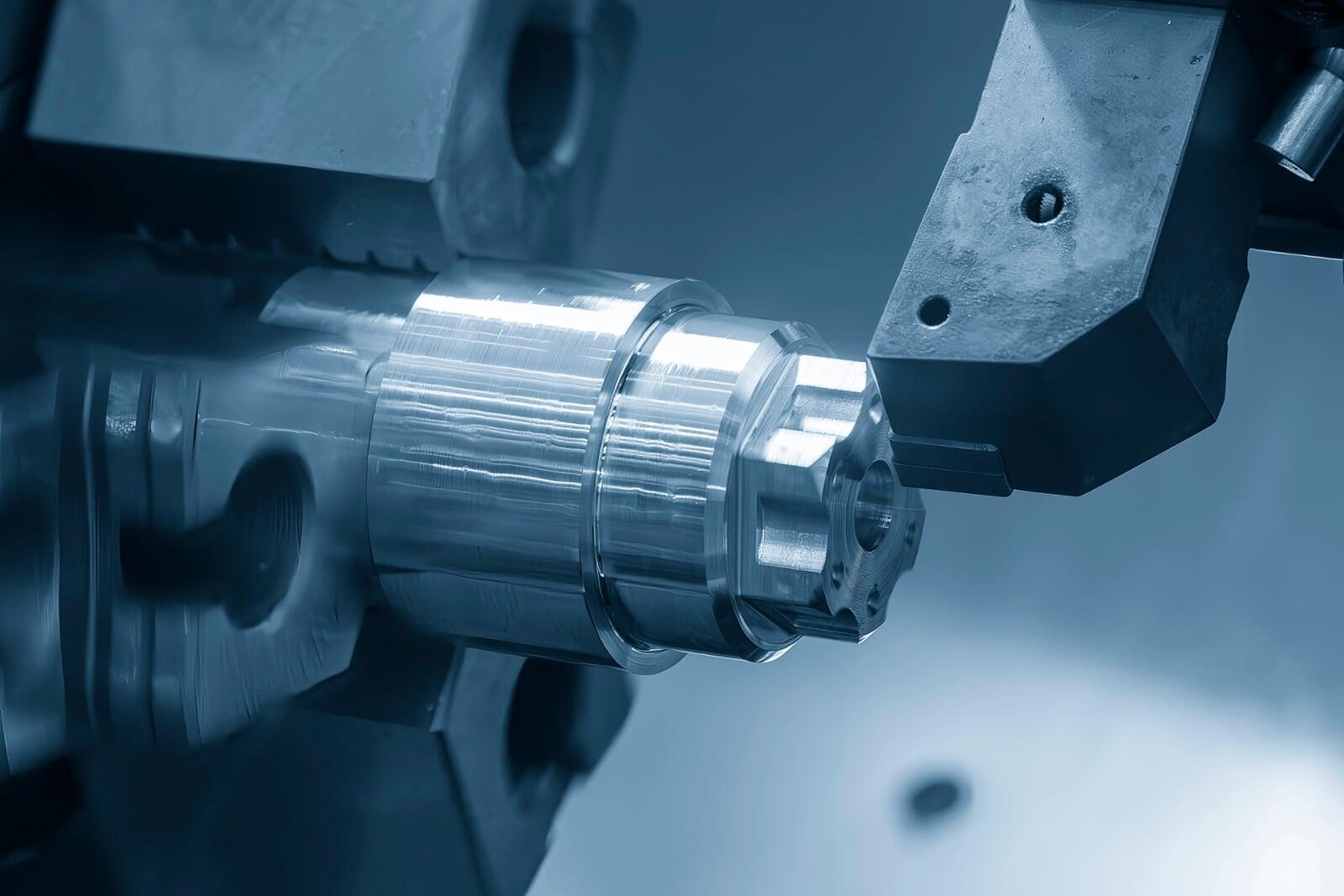

Precision machining companies with advanced CNC capabilities and specialized certifications are highly sought after by strategic buyers seeking to expand manufacturing capabilities. We position your machining business to attract premium acquirers by highlighting technical expertise, customer diversification, and capacity for high-value projects.

Custom fabrication shops supporting construction, energy, and infrastructure projects are key M&A targets due to their essential role in critical supply chains. We help structure transactions that preserve operational value, maintain customer relationships, and ensure smooth transitions while maximizing enterprise value for sellers.

From industrial packaging to consumer-facing solutions, packaging businesses are increasingly attractive to buyers due to e-commerce growth and supply chain modernization trends. Our team helps packaging companies leverage their automation investments and market positioning to achieve optimal valuations in competitive acquisition processes.

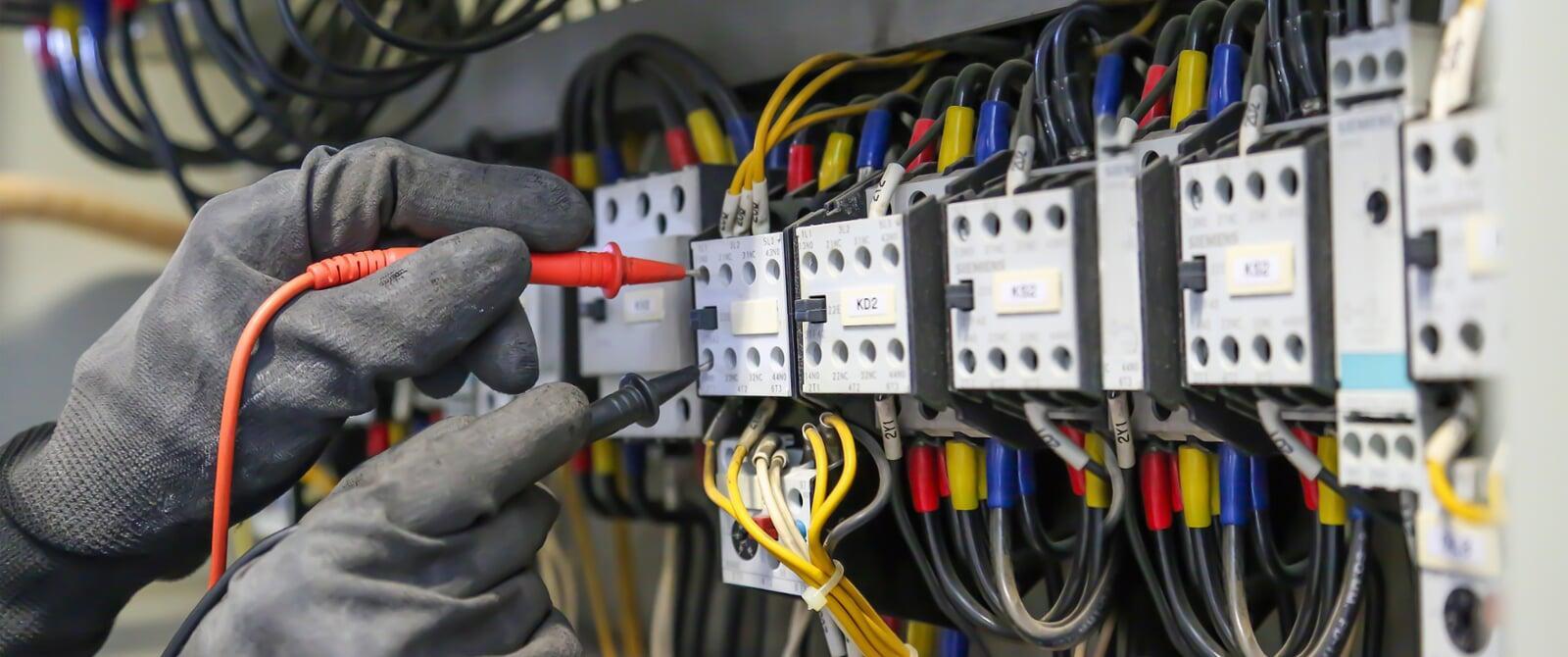

Producers of control panels, wiring harnesses, and electrical assemblies play vital roles across manufacturing and infrastructure sectors. We highlight technical expertise, industry certifications, and compliance capabilities to attract strategic buyers seeking specialized electrical manufacturing capabilities or market access.

Forging, stamping, and sheet metal businesses are critical suppliers to automotive, construction, and heavy industry supply chains. Their specialized capabilities and substantial capital investments make them highly sought-after acquisition targets for companies seeking vertical integration or market expansion.

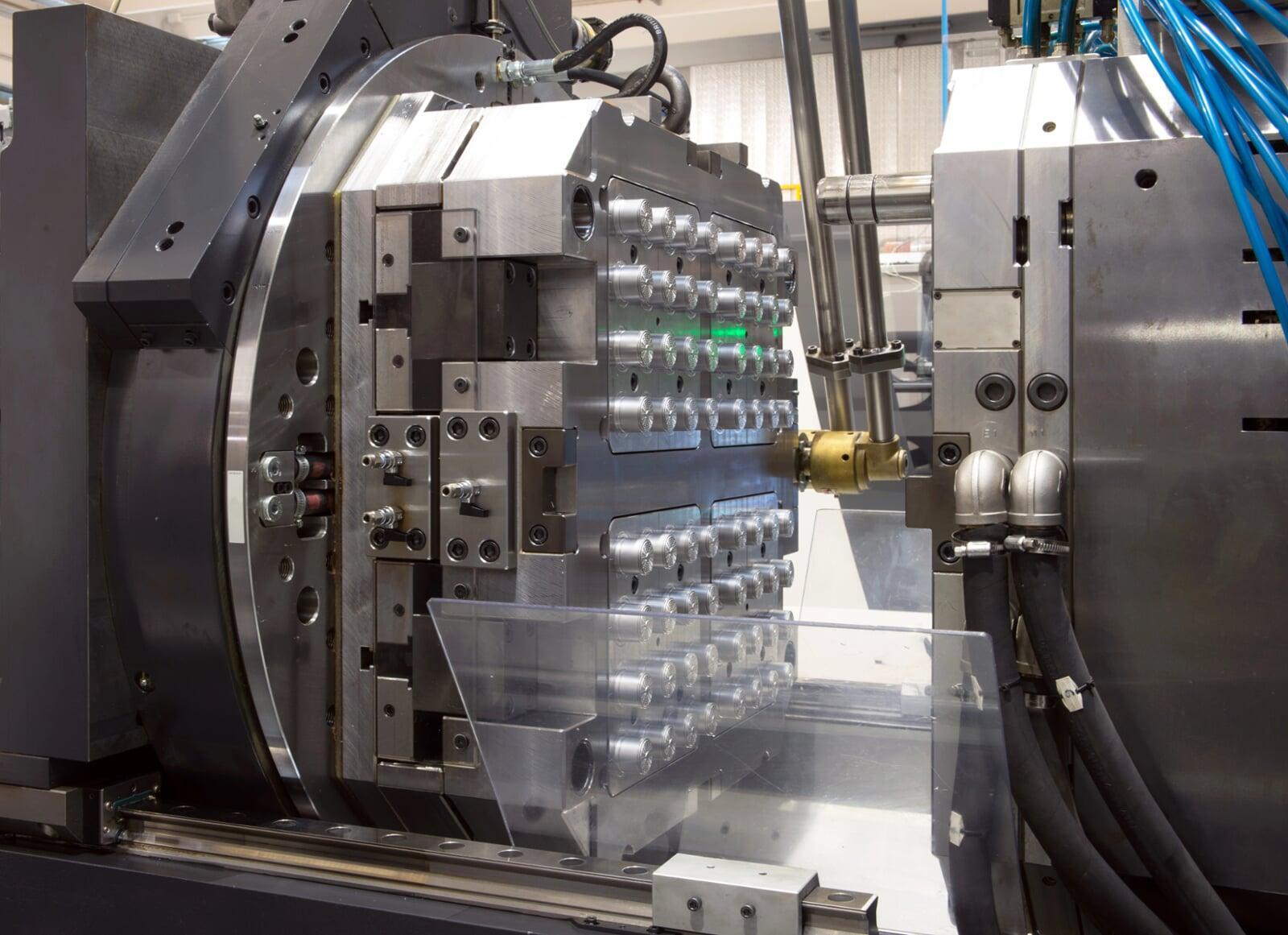

Molded plastics and rubber component manufacturers supporting automotive, healthcare, and industrial applications operate in a segment experiencing rapid consolidation. We help position these businesses to capitalize on industry trends while highlighting specialized processes, quality systems, and customer diversification strategies.

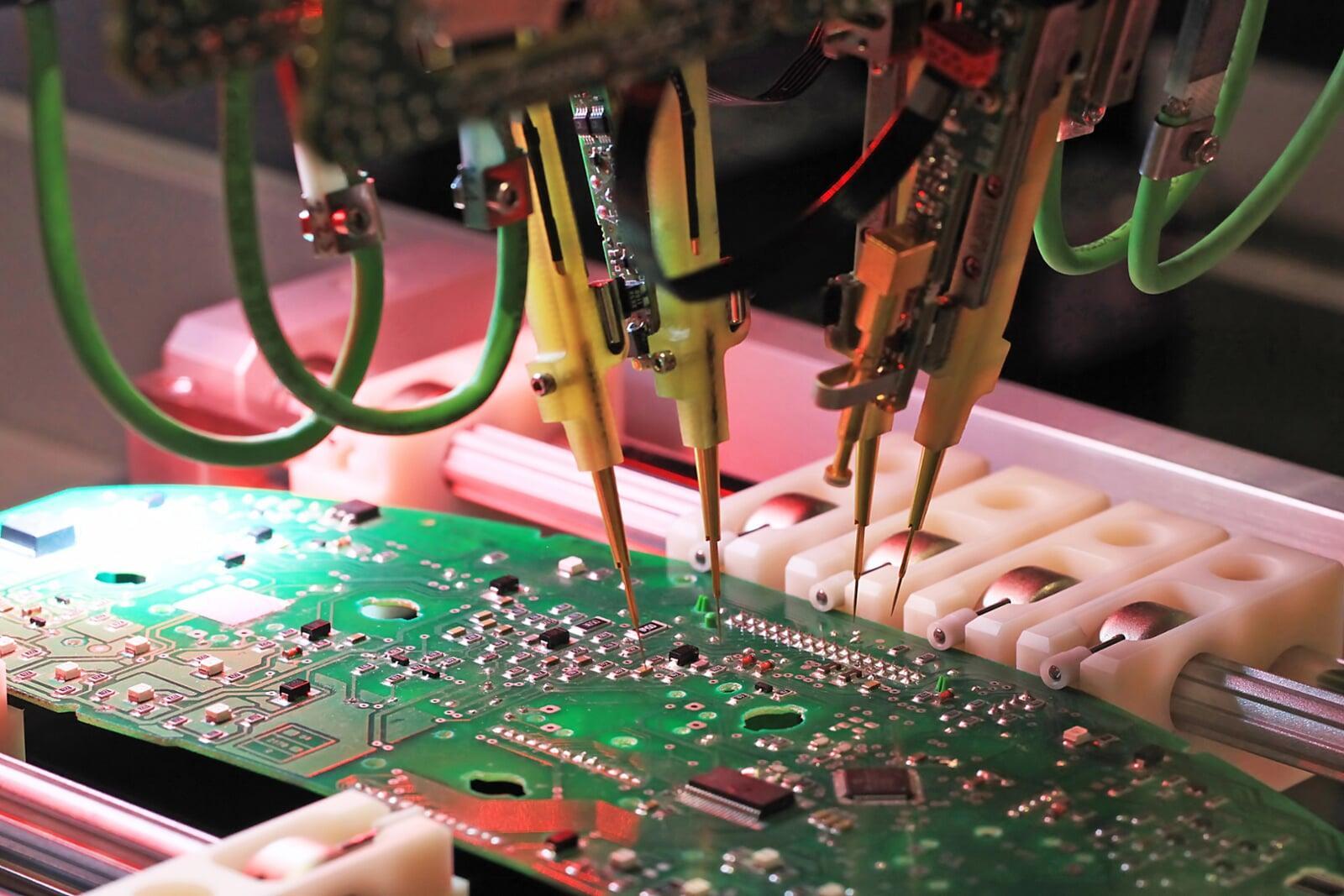

Electronic component and PCB assembly manufacturers attract strategic interest from defense, aerospace, and technology sectors. We help position these businesses for premium valuations by emphasizing technical capabilities, quality certifications, and relationships with tier-one customers in high-growth markets.

Machinery builders and equipment servicers represent attractive opportunities for private equity and consolidators seeking durable, asset-backed businesses with recurring revenue streams. We highlight the value of established dealer networks, service capabilities, and proprietary designs that create competitive advantages.

Specialized fabricators serving aerospace and defense markets command premium valuations due to certification requirements, security clearances, and high barriers to entry. We help these businesses leverage their certifications and compliance capabilities to attract strategic buyers seeking expansion in regulated, high-value markets.

Producers of adhesives, coatings, and specialty compounds often achieve strong valuations given regulatory complexity and recurring customer demand. Our team helps specialty chemical companies highlight proprietary formulations, regulatory approvals, and long-term supply agreements that create predictable revenue streams attractive to buyers.

Why Choose Us For Industrial Transactions

Deep understanding of industrial supply chains and market consolidation trends.

We operate with full confidentiality- ensuring discretion and bespoke service.

Tailored approach to highlight technical expertise and recurring revenue models.

Access to a global buyer and investor network.